This post is sponsored by the fine folks at You Need A Budget When the Mark and I were first married, finances were a constant issue for us. We spent our first three years of marriage as graduate students, working part-time, going to school full-time, and trying to pay for our education. It was a challenge. We were constantly broke. We tried a number of budget solutions, and money was a constant source of stress. Once we graduated, it wasn’t an instant fix. Mark work in the ministry for 10 years. It was a job that he loved, but it was a job that paid very little. In fact, we laughed this year because the money we owed on our tax return was more than the money he made annually at the church where he worked. We did a lot of creative budgeting in those days to make life work. I distinctly remember a time that we were gifted a day at Disneyland, but no budget for food. And we were so broke that we could not afford to eat at Disneyland. We pilfered lettuce and tomatoes and pickles from the hamburger fixings bar for our dinner. When our first child was a baby, Mark decided to leave the ministry and pursue doing therapy at a private practice full-time. At the time, I was also doing private practice. The income change was significant, and suddenly we were not having to budget so tightly. We were living much more comfortably, and not as pressed to figure out how to make ends meet every month. We were able to start saving. We bought a second house and kept our first as an income property. I started blogging, and eventually that became a full-time job for me. And because we weren’t living month to month, we stopped budgeting altogether. Don’t get me wrong, this is a good problem to have. But it is not necessarily a sustainable model. This past year, we upgraded to a bigger home. We needed an additional bedroom, and wanted to be in a neighborhood that was closer to parks and the beach. Property in our area is very expensive, and in order to afford a home, we had to buy a fixer-upper. We have always done this, and it has proved to be a great way to get into a neighborhood we could otherwise not afford. However, in this new house, we quickly found ourselves over our head. We ran into foundation problems, plumbing problems, and a host of other issues. Not to mention, the new mortgage payment was a big hit on our monthly budget. We are in the place where we need to start budgeting again. We need to budget the rest of our remodel in a way that doesn’t put us into further debt, and we need to reign in our spending in order to afford a larger mortgage payment every month. So when You Need a Budget reached out to me, I was like, “Funny you should mention that . . .” You Need a Budget is a robust budgeting software that works on your computer and iphone or Android device. It features Cloud Sync, which stays in sync wherever there’s an internet connection. You can use their app to record your spending right at the cash register.  It also allows you to import data directly from your bank, so you can make sure that all of your transactions are recorded into your budget.

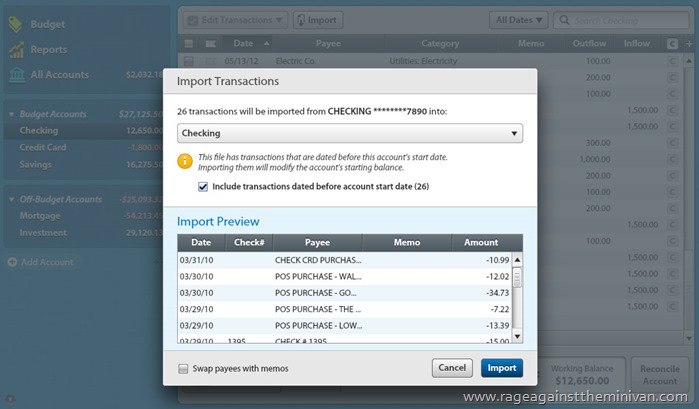

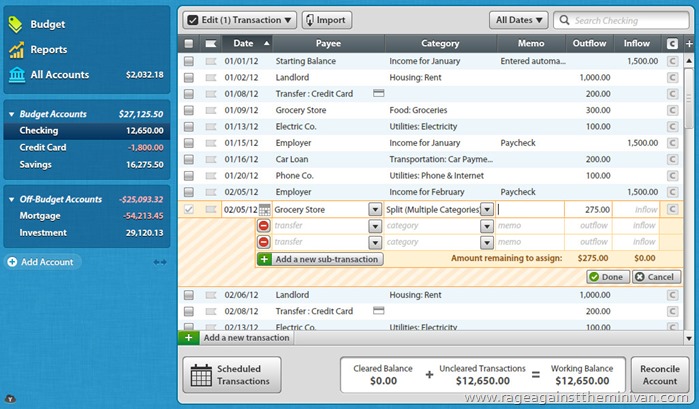

It also allows you to import data directly from your bank, so you can make sure that all of your transactions are recorded into your budget.  You Need A Budget has four brilliant rules: Rule 1: Every dollar has a job. It’s allocated to something, so that you aren’t tempted to use it for something else. When you’re proactively deciding what you want your money to do before you do it, your financial awareness increases. Nobody ever, with full awareness, says to themselves, “I’d like to bury myself in credit card debt.” Yet a lot of people end up in exactly that situation. Awareness simply assures that your money does what you want it to do.

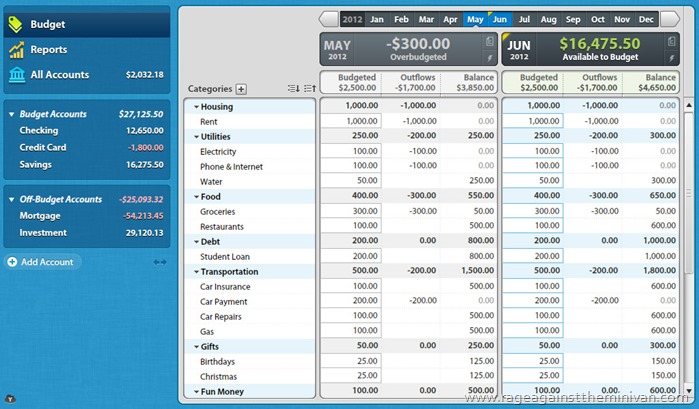

You Need A Budget has four brilliant rules: Rule 1: Every dollar has a job. It’s allocated to something, so that you aren’t tempted to use it for something else. When you’re proactively deciding what you want your money to do before you do it, your financial awareness increases. Nobody ever, with full awareness, says to themselves, “I’d like to bury myself in credit card debt.” Yet a lot of people end up in exactly that situation. Awareness simply assures that your money does what you want it to do.  Rule 2: Plan for bigger, less frequent expenses. Like paying taxes. Or a home remodel. Ahem. YNAB is built to let you easily set aside funds for larger items so that you are saving for the expense instead of scrambling when it’s time to pay. Rule 3: Roll with the punches. There is no expectation that you’ll ever have a single month without overspending in one or more categories. The value in budgeting doesn’t come from managing the easily foreseeable (though if ignored, these will nail you). Value comes from managing the unforeseeable more effectively. It’s all about how you handle months that are not normal. Hint: they’re never normal.

Rule 2: Plan for bigger, less frequent expenses. Like paying taxes. Or a home remodel. Ahem. YNAB is built to let you easily set aside funds for larger items so that you are saving for the expense instead of scrambling when it’s time to pay. Rule 3: Roll with the punches. There is no expectation that you’ll ever have a single month without overspending in one or more categories. The value in budgeting doesn’t come from managing the easily foreseeable (though if ignored, these will nail you). Value comes from managing the unforeseeable more effectively. It’s all about how you handle months that are not normal. Hint: they’re never normal.  Rule 4: Learn to live on last month’s income. When you’re living on last month’s income, that income number is the most accurate number in your budget. There’s no guessing about it. It’s what you earned last month down to the penny. If you’re a realtor and you pulled in $1,000 in commissions, you know you’re dealing with a low month. It’s a known. It’s reality, and you can do things to get by. If you earn $12,000 in a fantastic month, you can look ahead, figure not every month will be that great, and ready yourself for some slumps.

Rule 4: Learn to live on last month’s income. When you’re living on last month’s income, that income number is the most accurate number in your budget. There’s no guessing about it. It’s what you earned last month down to the penny. If you’re a realtor and you pulled in $1,000 in commissions, you know you’re dealing with a low month. It’s a known. It’s reality, and you can do things to get by. If you earn $12,000 in a fantastic month, you can look ahead, figure not every month will be that great, and ready yourself for some slumps.  We’ve been using the software for about a month and it has really helped us in figuring out how to both pay down the debt we’ve accrued so far in this renovation, and how to afford our new mortgage payment without going under every month. It’s simple and intuitive and I really love the fact that I can look at it on my phone. If you want to give it a try, they have a free 30-day trial here.

We’ve been using the software for about a month and it has really helped us in figuring out how to both pay down the debt we’ve accrued so far in this renovation, and how to afford our new mortgage payment without going under every month. It’s simple and intuitive and I really love the fact that I can look at it on my phone. If you want to give it a try, they have a free 30-day trial here.

Rage Against the Minivan sometimes earns revenue through sponsored posts, which are clearly labeled, and occasional affiliate links to recommended products. I only feature products that I truly like, and my opinions are always my own.