A day at the museum

This post was sponsored by the Natural History Museum of Los Angeles County. Last week the kids and I headed up to LA for the afternoon to visit the Natural History Museum of Los Angeles County. This is one of those local things that I have always heard about but never done. Kind of like the way I grew up in Florida and never visited the Florida Keys. As soon we got there, I felt frustrated with myself for never having taken the kids before. It's such a local gem, for both kids and adults. . . .

DIY Healthy Trail Mix

This post was sponsored by Blue Diamond Almonds. We took a trip down to San Diego with the kids this past weekend, and I wanted to give them some snacks that could keep them occupied (and by occupied I mean quiet) in the car. I will confess, usually our road trip fare isn’t the healthiest, and often involves us letting them buy a bag of chips and a lollipop when we’re fueling up for gas. I wanted to be a bit more proactive, so I thought I would let them make their own trail mix. One of the few . . .

Why Scholarshare?

This post was sponsored by Scholarshare. As I mentioned in a previous post, I’ve partnered with Scholarshare this year to provide information on California’s 529 college savings plan. Today, I wanted to provide some information about what sets this plan apart as an advantageous option. Here are some of the reasons we went with Scholarshare: There are major tax breaks 529 plans offer significant income tax breaks. Although your contributions are not deductible on your federal tax return, your . . .

My test-driving, gun-shooting, off-roading weekend in Texas

A couple weeks ago, I was invited to San Antonio for a day of test-driving with Continental Tires. I wasn’t really sure what to expect. I’m not a big “car person” and I’ve certainly never been to a test track. And I had absolutely no knowledge or opinion on tires. The day after we flew in (and a lovely dinner on the River Walk), we woke up bright and early to drive out to Continental’s “proving grounds” . . . an expansive space dedicated to testing out tires. They wanted to . . .

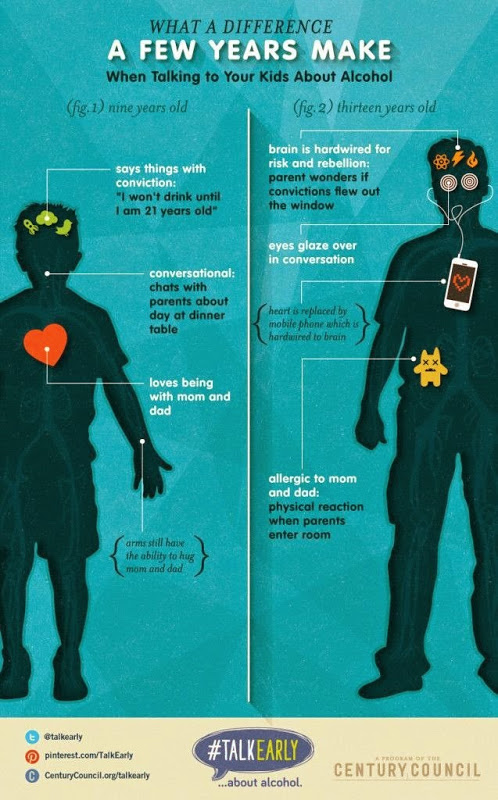

Setting the stage for our kids to confide in us

This post was sponsored by the Foundation for Advancing Alcohol Responsibility in collaboration with the Talk Early campaign, an initiative to empower parents to talk with their kids about alcohol. My oldest is nine years old. Which seems ridiculously old at this point in our lives. Though in about six years, that sentence I just wrote will seem really, really cute. Nine! What tiny babies I had back then, I'll tell myself, attempting not to ugly cry. His age—nine—sticks with me because of a . . .

An easy way to bring clean water to people in need

Every once in a while my blog provides our family with a really cool experience, and today was one of my favorites. P&G sent us a sample of their water purification packets, which are a part of their Children’s Safe Drinking Water Program. Our goal: make some water really dirty, and use the packet to turn it into clean water. The kids were SO excited. In fact, it attracted half of the neighborhood, and I loved hearing the kids explain their impassioned understanding of the world’s water . . .

Spring break staycation

This post is sponsored by Blue Diamond Almonds. My kids had spring break last week. We took a big trip for their winter break, which feels like it was just two weeks ago. And unfortunately, that set the kids expectations up for a big trip for spring break as well. That’s the problem with doing fun things with kids . . . everything after is just a big disappointment. Like the one Tuesday I surprised the kids and took them to Disneyland after school. Before that, Tuesdays were just Tuesdays. After . . .

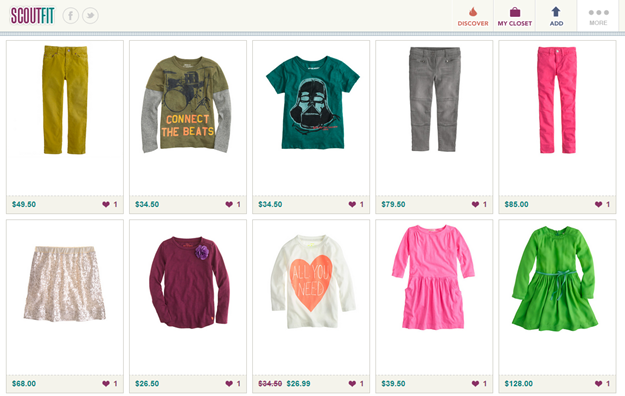

Scoutfit: not just for outfits

This post was sponsored by Scoutfit. A couple weeks ago I wrote about a new service that helps monitor sales of things you put on your wishlist. Scoutfit lets you designate clothing (or makeup or furniture or anything, really) and then combs the internet once a day to check if the item you want is on sale. It watches a huge number of websites including most of my favorites:Gap,Madewell, J. Crew, Free People, Anthropologie, and Old Navy. It even utilizes a little browser button (like the Pin-it . . .

Scoutfit: bargain shopping for busy folks

This post was sponsored by Scoutfit, At this stage of life, I do most of my shopping online. I like clothes and fashion, but I don’t love going to the mall. Many of the malls here are pretentious and obnoxious (I’m looking at you, Facist Island), and walking around a mall is not my preferred way to spend my rare alone time. So I do a lot of online shopping . . . trying clothes on at home and then returning them by mail if they don’t fit. I think it’s much less time-consuming than going to . . .

100 Cars for Good charity highlight: The Children’s Lunchbox

This post is sponsored by Toyota’s philanthropy program 100 Cars for Good. This month, I’m excited to be highlighting five unique charitable organizations that are making a difference in their community. Each charity was also the recipient of a new car to aid in their mission, courtesy of Toyota’s 100 Cars for Good program. (Know a charity that could use a car? You can vote for them at Toyota’s 100 Cars for Good Facebook App. Today, I’m talking with The Children’s Lunchbox. Tell me about what . . .